Wall Street rebounded on Friday, with the S&P 500 posting its first gain since Christmas Eve, potentially breaking a five-day losing streak, its longest since April.

The index rose 0.6 percent in morning trading as the Dow Jones Industrial Average increased by 153 points (0.4 percent) and the Nasdaq Composite gained 0.9 percent.

Why It Matters

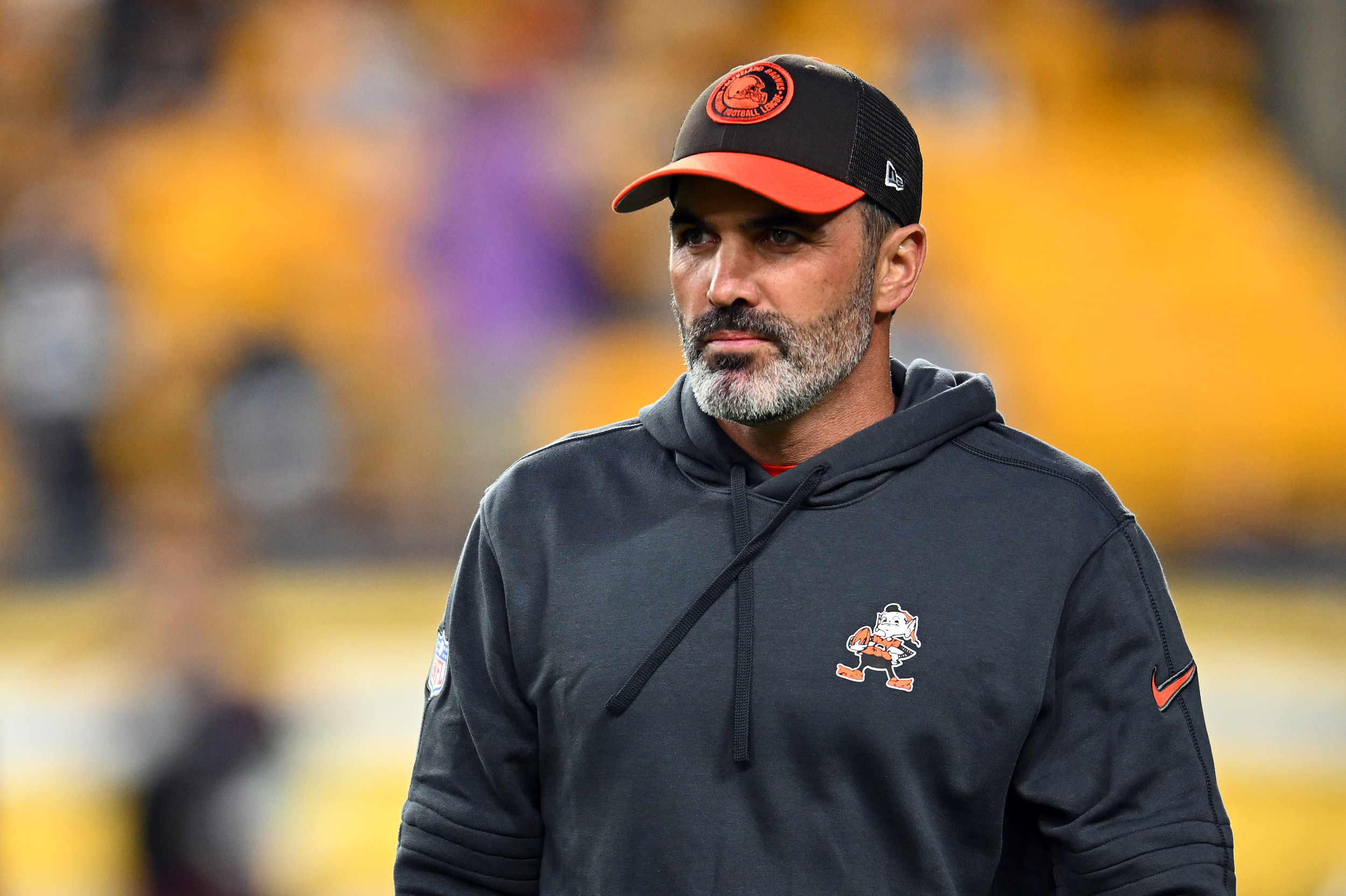

This rebound indicates renewed investor confidence following a period of market volatility. Californian tech firm Nvidia’s performance (a 3.9 percent climb) shows a sustained interest in artificial intelligence technologies, despite concerns regarding overly high valuations.

Tesla’s partial recovery (up 1.6 percent after a previous drop) suggests resilience in the electric vehicle sector, even amid delivery shortfalls. However, declines in industrial and consumer sectors highlight ongoing economic uncertainties ahead of President-elect Donald Trump‘s impending inauguration.

AP Photo/Seth Wenig

What To Know

While there has been a slight downturn in the stock market recently, this is minor compared to the significant gains the market experienced over the last two years. During this period, the U.S. economy grew despite high interest rates and a concerted effort by the Federal Reserve to reduce inflation, which is nearing its target of 2 percent.

Elsewhere, Rivian’s 16.1 percent surge followed its announcement about delivering over 14,000 vehicles in the same period, surpassing analyst expectations by some margin.

Why Has the S&P Performed So Well?

The recent record highs in the S&P 500 were partly driven by optimism that the Federal Reserve would continue cutting interest rates through 2025, making borrowing cheaper and encouraging economic activity. However, this optimism has waned as inflation proves more persistent, making future rate cuts less likely.

Inflation remains challenging to fully control. Despite progress, the Fed still needs to address the last percentage points to hit its target. Meanwhile, traders are growing cautious, reflecting the complexity of balancing economic growth and inflation management.

Trump’s proposed tariffs and trade policies could exacerbate inflation by increasing the cost of imported goods. These policies might raise consumer prices and further strain efforts to keep inflation in check.

BING-JHEN HONG/Getty Images

Which Companies Have Suffered Since 2025 Began?

In contrast, U.S. Steel fell 6.4 percent after President Joe Biden blocked a proposed $15 billion acquisition by Japan’s Nippon Steel. An executive order, delivered Friday, cites national security concerns for pulling the deal.

Alcohol-related stocks declined after U.S. Surgeon General Vivek Murthy warned about the link between alcohol consumption and cancer risk.

“This advisory highlights alcohol use as a leading preventable cause of cancer in the United States, contributing to nearly 100,000 cancer cases and about 20,000 cancer deaths each year,” his document stated. “The more alcohol consumed, the greater the risk of cancer.”

Murthy called for an update on the health warning label on alcoholic drinks to reflect the dangers presented.

Molson Coors Beverage fell 2.5 percent. Constellation Brands, which sells Modelo beer and Robert Mondavi wine, dropped 1.2 percent.

What People Are Saying

Solita Marcelli, Chief Investment Officer for the Americas at UBS Global Wealth Management, said: “While the easy gains in AI may be behind us, we think this rally looks far from over.”

Analyst Elsa Ohlen wrote via Barron’s: “Nvidia has so far led the gains of the group of Magnificent Seven stocks that includes Apple, Microsoft, Amazon.com, Alphabet, Meta and Tesla—of which five of them have fallen over the past five trading days, while Meta and Amazon are trading largely flat … Investors might simply be feeling optimistic about the fresh start a new year often brings, especially after Nvidia notched a second year straight of triple-digit gains.”

Eva Marie Uzcategui/Getty Images

What Happens Next

Investors will monitor upcoming economic indicators, including construction spending and manufacturing data, for further market direction. Tesla‘s earnings report, scheduled for January 29, will provide insights into its performance and future outlook.

Additionally, potential policy changes under the incoming Trump administration, such as corporate tax cuts and increased tariffs, may influence market dynamics. The Federal Reserve’s stance on interest rates will also be closely watched, especially in light of persistent inflation concerns.

This article includes reporting from The Associated Press.